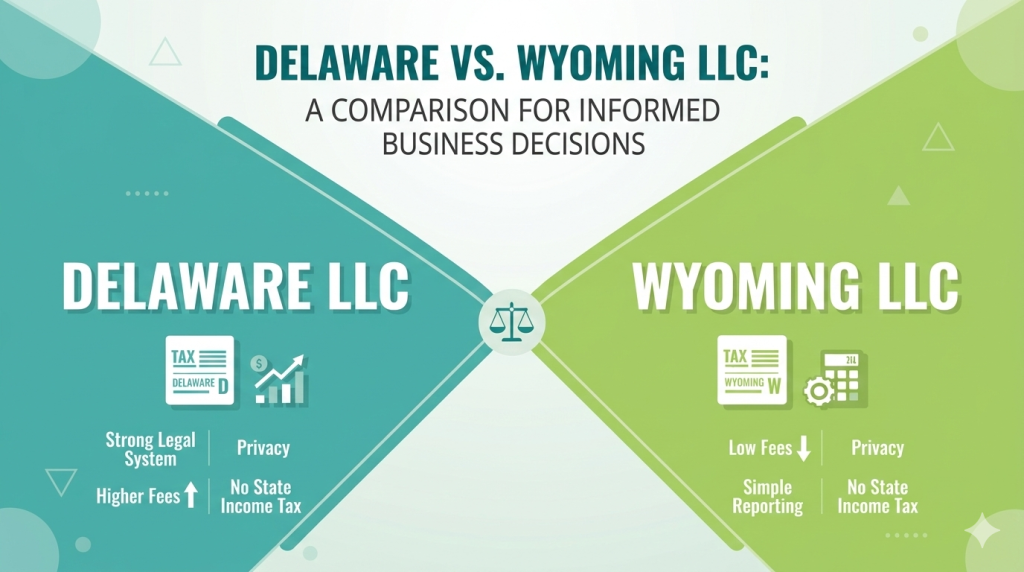

Choosing the right state to form your LLC is one of the most consequential decisions you’ll make as a business owner. Two states consistently rise to the top of that conversation: Delaware and Wyoming. Both are business-friendly, but they serve very different types of entrepreneurs and business models.

In this guide, we break down everything you need to know from taxes and fees to privacy protections and legal flexibility so you can make a truly informed decision.

Why State of Formation Matters

Here’s something many first-time business owners don’t realize: you can form your LLC in any state, regardless of where you live or operate. That means you’re not locked into your home state. You get to choose the jurisdiction whose laws, costs, and protections best align with your goals.

Delaware and Wyoming have both positioned themselves as LLC-friendly states, but their advantages appeal to very different business owners.

Delaware LLC: The Corporate Powerhouse

Delaware has long been the gold standard for business formation in the United States. Over 67% of Fortune 500 companies are incorporated in Delaware and there are very good reasons for that.

Key Advantages of a Delaware LLC

- The Court of Chancery, Delaware’s specialized Court of Chancery handles business disputes without juries. It’s staffed by judges called “chancellors” who are experts in business law. This leads to faster, more predictable outcomes in legal disputes, which is extremely valuable for investors and venture-backed companies.

- Well-Established Legal Precedent Centuries of business case law mean that Delaware’s legal framework is deep, nuanced, and well-understood. Attorneys, investors, and courts across the country are familiar with Delaware law, which reduces legal uncertainty.

- Investor Confidence If you’re planning to raise venture capital or bring in outside investors, Delaware is almost universally preferred. Most VCs and institutional investors require businesses to be incorporated or formed in Delaware as a condition of funding.

- Flexible LLC Operating Agreements Delaware gives LLC members enormous flexibility in structuring their operating agreements. You can customize management structures, profit distributions, and member rights far beyond what most states allow.

- No State Income Tax for Non-Residents If your LLC does not operate within Delaware, you generally won’t owe Delaware state income tax even though you’re formed there.

Disadvantages of a Delaware LLC

- Franchise Tax & Fees: Delaware charges an annual franchise tax and registered agent fees, which can add up.

- Registered Agent Required: You must maintain a registered agent in Delaware, adding a recurring cost.

- Double Registration: If you operate in another state, you’ll likely need to register as a foreign LLC there too, doubling your filing requirements.

- Not Ideal for Small Businesses: The cost and complexity may outweigh the benefits for sole proprietors and small local businesses.

Wyoming LLC: The Privacy and Tax Haven

Wyoming quietly became one of the most business-friendly states in the country, particularly for entrepreneurs who prioritize privacy, low costs, and asset protection.

Key Advantages of a Wyoming LLC

- Zero State Income Tax: Wyoming has no state income tax for individuals or businesses. This is a significant advantage for LLC members who want to minimize their overall tax burden.

- Strong Asset Protection Wyoming was actually the first state to create the LLC back in 1977, and its asset protection laws reflect that legacy. Wyoming offers some of the strongest charging order protections in the country, meaning creditors generally cannot seize your LLC interest to satisfy personal debts.

- Exceptional Privacy Wyoming does not require the names of LLC members or managers to be listed in public filings. You can form an anonymous LLC, keeping your ownership information off the public record a significant advantage for privacy-conscious entrepreneurs.

- Low Fees Wyoming’s LLC formation and annual fees are among the lowest in the nation. The annual report fee is just $60 for LLCs with less than $300,000 in assets within the state extremely affordable compared to many other states.

- No Franchise Tax: Unlike Delaware, Wyoming does not charge a franchise tax. Just to let you know, your ongoing costs of maintaining a Wyoming LLC are minimal.

- Series LLC Available in Wyoming allows Series LLCs, enabling business owners to create multiple “cells” within one LLC, each with its own assets, liabilities, and members, without forming separate entities.

Disadvantages of a Wyoming LLC

- Less Name Recognition with Investors: Wyoming doesn’t carry the same weight as Delaware in the investment community. If you plan to raise VC funding, this could be a hurdle.

- Less Developed Case Law: Wyoming simply doesn’t have Delaware’s depth of business legal precedent, which can mean more uncertainty in complex disputes.

- Foreign Registration Still Required: Just like Delaware, if you operate in another state, you’ll need to register as a foreign LLC there as well.

Delaware vs. Wyoming LLC: Side-by-Side Comparison

Feature | Delaware LLC | Wyoming LLC |

State Income Tax | None (for non-residents) | None |

Annual Fees | $300+ (franchise tax + agent) | ~$60/year |

Privacy | Moderate | High (anonymous LLC) |

Asset Protection | Strong | Very Strong |

Investor Preference | Very High | Low |

Legal Precedent | Extensive | Limited |

Series LLC | No | Yes |

Court System | Specialized (Court of Chancery) | Standard |

Formation Cost | ~$90–$200 | ~$100 |

Which LLC Is Right for You?

The right choice depends entirely on your business goals. Here’s a simple framework:

Choose Delaware if you:

- Plan to raise venture capital or angel investment

- Expect complex shareholder or member agreements

- Anticipate legal disputes that benefit from expert business courts

- Are building a startup with a path toward acquisition or IPO

- Need credibility with institutional partners

Choose Wyoming if you:

- Are a solo entrepreneur or small business owner

- Value privacy and want to keep ownership information off public records

- Want the lowest possible formation and maintenance costs

- Need strong personal asset protection

- Are you building a holding company or real estate investment structure

- Don’t plan to seek outside investors

What About Taxes? The Federal Picture

It’s worth noting that both Delaware and Wyoming LLCs are pass-through entities for federal tax purposes by default. This means the LLC itself doesn’t pay federal income tax; profits and losses pass through to the members’ personal tax returns.

Neither state provides a federal tax advantage over the other. Your federal tax treatment will be the same regardless of which state you choose. The tax differences are purely at the state level, and both states are favorable in that regard.

The Hidden Cost: Foreign LLC Registration

Here’s a reality check that applies to both options: if you don’t actually live or operate in Delaware or Wyoming, you’ll need to register as a foreign LLC in your home state.

This means:

- Paying your home state’s registration fees

- Filing annual reports in both states

- Maintaining registered agents in both states

For many small business owners, this doubles the administrative burden and cost. Always factor this into your decision; sometimes it’s simply more practical to form your LLC in the state where you actually do business.

Frequently Asked Questions

Can I change my LLC’s state of formation later?

Yes, through a process called domestication or conversion, though it varies by state and can involve legal and tax implications. It’s better to choose correctly from the start.

Do I need a lawyer to form an LLC in Delaware or Wyoming?

No, but it’s advisable for complex structures. Both states allow online self-filing or use of formation services.

Is Wyoming LLC truly anonymous?

Wyoming allows you to keep member names off public filings, but you still need to provide ownership information to the IRS. “Anonymous” refers to public records, not federal tax requirements.

Which state is better for a real estate holding company?

Wyoming is generally preferred for real estate holding LLCs due to its strong asset protection, low costs, and series LLC option.

Which state is better for a tech startup?

Delaware, almost without exception, due to investor preference and its robust legal infrastructure.

Final Verdict

Both Delaware and Wyoming offer compelling advantages, but they serve fundamentally different business needs.

Delaware is the clear winner for startups, investor-backed businesses, and companies that need legal sophistication and credibility.

Wyoming is the clear winner for privacy-focused entrepreneurs, small businesses, holding companies, and anyone who wants maximum asset protection with minimal cost.

Neither is universally “better.” The best choice is the one that aligns with your specific business model, growth plans, and priorities.

Take the time to evaluate both options or consult with a business attorney before making your final decision. The state you choose will shape the legal and financial foundation of your business for years to come.